Donna Achimov

Chief Compliance Officer at FINTRACDonna Achimov is the Chief Compliance Officer/ Deputy Director at the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), responsible for assisting and assessing compliance with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and its Regulations. Ms. Achimov has also served as the Deputy Director of FINTRAC’s Corporate Management Services sector and Chief Financial Officer. She is an experienced leader who has held numerous positions within the Government of Canada, including CEO of the Government of Canada’s Translation Bureau and Assistant Deputy Minister for Human Resources at Public Services and Procurement Canada. Ms. Achimov has served as Acting Assistant Deputy Minister, Receiver General and Pensions, where she gained insight into Canada’s banking industry and the complexity of risk management.

Ms. Achimov holds an Honours Bachelor’s degree in journalism from Carleton University. She is a graduate of the Directors Education Program from the Institute of Corporate Directors at the Rotman School of Management, University of Toronto.

She is passionate about changing the workplace culture to allow more innovation and creativity and speaks frequently on topics of leadership, mental health, diversity, values and ethics and issues that will affect the next generation of public service leaders.

Joseph Dixon

Manager at FINTRACJoseph joined FINTRAC’s Toronto office as a Compliance Officer in 2014, bringing significant AML experience in the financial services industry, including roles in a top five bank and global consulting firm. Since joining FINTRAC, he has held incrementally more senior positions within operations and policy functions. He has managed collaborative and productive relationships with both internal and external stakeholders, including OSFI, CIRO, and OSC. In 2020, Joseph was appointed Manager for the Follow-Up and Strategic Engagement (FUSE) Team in Toronto and has played a key role in advancing the transition of AML/ATF supervisory responsibilities from OSFI to FINTRAC while developing processes and tools supporting the complex workload associated with financial institutions. Last year Joseph was seconded to FINTRAC’s International Relationships team where he supported the FATF relationship and preparations for Canada’s upcoming Mutual Evaluation. Joseph is currently a Manager in the Supervision sector where he manages a team of supervisors overseeing the securities, credit union, and trust and loan sectors.

Joseph holds an honours Bachelor’s degree from York University in Law Society and a Master of Laws degree from University of Toronto’s Faculty of Law.

Asya Boskovic

Manager, Banking Sector, Financial Institutions Unit, Supervision Sector at FINTRACAsya Boskovic has been with FINTRAC since October 2014 working in various capacities within the Compliance Sector. She has extensive experience in delivering compliance activities within the Canadian financial industry, particularly in the banking sector. Most recently, she was appointed as a Compliance Manager within the Toronto Office bank teams with a focus on overseeing a team of regional compliance officers responsible for examining the banking industry against the Proceeds of Crime Money Laundering Terrorist Financing Act and Regulations. She also manages the portfolio relationships of major financial institutions and small-medium sized banks which includes providing strategic direction to the Centre on compliance monitoring approaches and engagement. In this capacity she also works on developing strategic partnerships with domestic and foreign regulators for the banking sector.

Previously, Asya held several AML/ATF roles working for a large financial institution as a financial crime expert. Notably, she became a subject matter expert in analyzing fraud related scenarios as well as ensuring the Bank was compliant with various sanction regulations.

Asya maintains a graduate certificate from Seneca College in Fraud Examination and Forensic Accounting as well as a Bachelor’s Degree with Honors from York University in Law and Society. She also obtained certifications with the Association of Certified Fraud Examiners (CFE) and the Association of Certified Anti-Money Laundering Specialists (ACAMS).

Gabriel Ngo

Director, Governor’s Review Office, Supervision of Bank of CanadaGabriel Ngo is the Director of Enforcement for Retail Payments Supervision. In this role, he leads the design and implementation of the enforcement framework for the Bank of Canada’s new supervisory mandate, including its administrative monetary penalty regime and the internal review process to be conducted by the Governor.

Prior to joining the Bank, Mr. Ngo was a Senior Advisor with the Department of Finance Canada, where he developed a professional expertise in stakeholder and international relations, regulatory compliance, as well as administrative law. Mr. Ngo has done extensive work on financial sector policy issues, including combatting financial crimes, financial technology, digital identity, and cryptocurrencies. In this capacity, he represented Canada at the United Nations Office on Drugs and Crime (UNODC), in the Financial Action Task Force (FATF), and was Canada’s Head of Delegation to the Asia/Pacific Group on Money Laundering.

Mr. Ngo holds a Bachelor of Commerce (B.Com.) and a Juris Doctor (J.D.) from the University of Ottawa.

Catherine Jarmain

Director, Industry Programs and Monitoring of iGaming OntarioCatherine Jarmain joined iGaming Ontario as Director of Industry Programs and Monitoring in April 2021. In this role, Catherine is responsible for iGaming Ontario’s anti-money laundering and responsible gambling programs and has oversight of contracts with operators and player disputes.

Before joining iGaming Ontario, Catherine was Director of Regulatory Intelligence and Innovation at the Alcohol and Gaming Commission of Ontario (AGCO), responsible for integrating analytics into strategy and policy. Concurrently, she was a director in the Ontario Provincial Police’s Investigation and Enforcement Bureau, leading a team applying analytics to anti-money laundering work. Catherine previously served as Director of Policy and Social Responsibility at Ontario Lottery and Gaming (OLG) and has held roles at Manulife Financial, The Economist and the Government of Canada.

Catherine holds a BA in Honours Economics from McGill University, an MA in International Relations from Johns Hopkins University’s School of International Studies, and an MBA from Ivey Business School at Western University. She has completed certifications in data analytics, anti-money laundering and business coaching.

Safeena Alarakhia

Senior Advisor, Financial Crimes at Department of Finance CanadaSafeena is a Senior Advisor, Financial Crimes at the Department of Finance Canada which leads Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime. She has worked in the federal government for over 15 years, at the Department of Finance and Global Affairs Canada, in the areas of anti-money laundering and anti-terrorist financing, economic sanctions and program evaluation and performance measurement. Safeena has worked on both domestic and international financial crime policy and governance issues, and previously represented Canada at the Caribbean Financial Action Task Force. She has a B.Comm from McGill University and a Master of International Affairs from Columbia University.

Amber D. Scott

Co-Founder & Chairman of Outlier Solutions Inc.Amber is a compliance geek with a passion for technology. After graduating from the University of Waterloo, Amber joined the compliance group at one of Canada’s largest insurers where she focused on the implementation of technology-based processes to streamline compliance. She has since worked in in-house roles with major securities firms and banks. Somewhere along the line, she added MBA, CBP, and a few other letters after her name.

Amber joined a boutique compliance consulting firm, then larger consulting firm, before getting frustrated enough with the status quo to launch Outlier Solutions Inc. (Outlier) in 2013. Outlier specializes in anti-money laundering (AML) and privacy compliance. The company is based on one of the premises of Malcolm Gladwell’s book Outliers: that to be really good at something you need a lot of practice (about 10,000 hours).

Each of Outlier’s team members has 10,000 hours or more of in-house (not consulting) compliance experience. Amber loves leading this team of entrepreneurial compliance badasses.

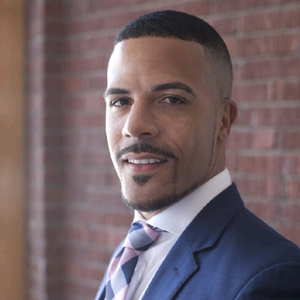

Mondiu Jaiyesimi

Senior Manager, AML Regulatory Compliance and Forensics at MNPMondiu is a member of MNP’s Forensics and Litigation Support team in Toronto. Mondiu manages MNP’s anti-money laundering (AML) portfolio in Ontario. He focuses on AML / anti-terrorist financing advisory services to help reporting entities reduce risk and remain in compliance with regulatory requirements.

Mondiu helps banks, credit unions, money services businesses, financial technology firms, accounting firms and payment services providers with their compliance program needs. This includes building AML programs, compliance effectiveness reviews, AML policy and program reviews, enhance due diligence and know your client projects, AML remediation validation audits, transaction monitoring, AML scenario testing, sanctions governance and risk assessment.

Prior to joining MNP, Mondiu gained extensive experience in AML, financial crime compliance and complex compliance investigations at two of Canada’s major financial institutions, a Big Four global consulting firm, an American global consulting firm, and three of the top four banks in the United Kingdom.

Mondiu earned a Bachelor of Science (BSc) in economics from the University of Lagos, Nigeria in 2007 and a Master of Science (MSc) in economics from the Surrey School of Economics, University of Surrey, UK in 2011. He is a Certified Anti-Money Laundering Specialist (CAMS), Certified Bitcoin Professional (CBP) and Financial Intelligence Specialist (FIS).

Glenna Smith

Managing Director of Smith Compliance ConsultingGlenna Smith (CAMS) is a Certified Anti-Money Laundering Specialist, CEO and Founder of Smith

Compliance Consulting Inc., a Board member of the Caribbean Regional Compliance Association

(CRCA), Director of the Barbados International Business Association (BIBA) and former President of the Barbados Association of Compliance Professionals (BACP).

Glenna loves to take technical compliance information and make it easy to understand. She has gained

in-depth knowledge in financial crime, compliance, operational risk and corporate governance during 35 years in financial services.

Glenna is a hands-on practitioner whose goal is to help achieve better compliance for clients, having

worked as a Compliance Officer facing regulators, managing inspections and enabling ongoing

compliance.

Glenna speaks regularly at conferences regionally and internationally on AML/CFT and various related

topics.

Kevin DeBruyckere

Director, AML & Investigations of British Columbia Lottery Corporation (BCLC)As the Director of AML & Investigations for the British Columbia Lottery Corporation (BCLC), Kevin is responsible for ensuring BCLC’s compliance with the PCMLTFA. He has extensive experience in law enforcement with the Royal Canadian Mounted Police responsible for the federal policing program in British Columbia, including responsibility for drug enforcement, transnational organized crime investigations, white collar crime, and national security. This was followed by four years with a large international bank as its Canadian Head of Anti Money Laundering Investigations before joining BCLC in 2019. He also provided testimony before the Commission of Inquiry into Money Laundering in British Columbia. In 2022, Kevin earned his Master of Business Administration degree from Royal Roads University

Lori Stein

Partner at McCarthy Tetrault LLPLori Stein is Co-Head of McCarthy Tétrault’s Fintech Group and a partner in the firm’s Business Law Group, more specifically our Securities Regulatory and Investment Products Group in Toronto. Lori advises Fintech businesses, portfolio managers, dealers, investment fund managers and institutional investors on all aspects of Canadian securities regulation. Lori is at the forefront of the fast-paced digital asset space, guiding clients on how to manage legal and regulatory risks associated with crypto assets and blockchain infrastructure. She regularly engages with the Canadian Securities Administrators on behalf of crypto asset trading platforms and other Fintechs.

Lori helps clients obtain regulatory approval for innovative business strategies through applications for registration and exemptive relief under securities and derivatives regulation, and advises on day-to-day compliance issues, investigations, regulatory audits and strategic transactions.

Clients appreciate Lori’s ability to bring clarity to the complexities of the Fintech industry. At a time when innovative technologies in the digital asset ecosystem are rapidly outpacing the existing rules and regulatory framework, Lori is at the forefront of these discussions and has a thorough understanding of the relevant key legal issues.

Claudius Otegbade

CEO of C&G Professional ServicesClaudius Otegbade is a highly experienced AML and Sanctions Consultant with over 18 years of working experience in anti-money laundering, forensic accounting, fraud investigation, and regulator audits. Prior to co-founding C&G Professional Services Inc., Claudius worked in the AML practice of both MNP LLP and Grant Thornton LLP, two international firm in Canada for over five years and recently held the position of the Director, Compliance at WFCU Credit Union, Ontario.

Claudius has a proven track record of conducting comprehensive AML Compliance audits and gap analyses, particularly for financial institutions, money services businesses, credit unions, crypto dealers, and precious metals and stones dealers. His capabilities extend beyond audits, into the creation and refinement of AML policies and procedures, and he is well-versed in the intricacies of FINTRAC examination assistance and the establishment of effective transaction monitoring frameworks. His forensic investigation experience is equally impressive, having consulted for municipal law enforcement and legal counsels to support critical investigations. He is a regular speaker at various AML conferences across Canada and a past and pioneer board member of the ACFCS, Toronto Chapter.

Prior to relocating to Canada 10 years ago, Claudius worked in the audit and assurance practice of PKF International in Nigeria among other notable indigenous oil and gas consulting firms.

Claudius holds a bachelor’s degree in Accounting and a Master’s in Business Administration (MBA). He is also an internationally trained chartered accountant (Nigerian FCA), CPA (New York), a Certified Anti-Money Laundering Specialist (CAMS), Certified Fraud Examiner (CFE), Certified Financial Crime Specialist (CFCS), Certified Forensic Investigator (CFI), Certified Bitcoin Professional (CBP), Certified Cryptocurrency Investigator (CCI), and an alumnus of the Fraud Examination and Forensic Accounting graduate program at Seneca College, Ontario.

Joseph Iuso

Executive Director of Canadian MSB AssociationJoseph is a solutions-focused Co-founder & Business Development with more than 30 years of success across the IT, AML compliance, banking, financial services, e-commerce, digital currency, and identity industries. He has leveraged his extensive experience in support of the financial services and retail payments sectors to ensure optimal ROI.

Joseph holds and has held many leadership positions at companies including KYC2020, Payment Source, Bitbuy Technologies, UseMyServices, TEKchand LLC, ACHreturnsRX, RBC, JAWZ, CIBC, Interac, and IBM.

Joseph holds a Computer Systems Technology degree from Mohawk College as well as numerous certifications in Project Management, Technology, and AML Compliance. As a volunteer, he currently sits on the Canadian MSB Association board as the Executive Director and Director of Technology for friends of HMCS Haida. In the past he has held board positions with the Canadian MSB Association (Former Chairman and founding member), the Canadian Tandem Users Group, and the Canadian Association of Compaq Users, and various other technology and spiritual not-for-profit charities and associations.

Joseph firmly believes in freely giving back to the community that has provided and continues to provide him with so much support.

Karen Creen

CAMLO, Sr. Compliance Officer at Bank of China, Toronto BranchKaren Creen is the Chief Anti-Money Laundering Officer and Sr. Manager of Compliance for Bank of China, Toronto Branch. An AML professional with over 20 years of industry experience, Karen moved into Compliance/AML in 2004 when her bank’s Compliance Department expanded to deal with upcoming changes to the PCMLTFA/R.

Since then Karen has worked with both Commercial and Retail banks in Canada, holding the CAMLO role at two Foreign Bank Branches in Toronto. Working with internationally owned banks has given her a big picture view of international AML requirements and provided in-depth knowledge of the differences between Canadian requirements and other international AML frameworks.

John Peleck

CAMLO at Coinsquare Capital MarketsJohn Peleck is the Chief AML Officer and Chief Risk Officer at Coinsquare Capital Markets a WonderFi Company the largest Crypto Currency Exchanges in Canada. John has over 20 years’ experience in Risk and Compliance roles within financial services and banking, he is CAMS certified.

Souzan Esmaili

Founder & CEO of TCAESouzan is a trailblazing force in the realm of Regulatory, Financial Crime and Crypto Compliance. With a distinguished career spanning over 18 years across international landscapes, she honed her expertise through roles in esteemed financial institutions and consultancies in Dubai and Toronto.

Throughout her journey in Dubai, Souzan has served as an Authorized Individual by the regulator, Dubai Financial Services Authority (DFSA), helped with major remediation projects and acted as Compliance Officer and MLRO for various firms.

Upon relocating to Canada in 2019, Souzan's commitment to excellence led her to establish TCAE, a platform dedicated to educating and empowering compliance and AML professionals and offering training, consultancy, and recruitment services to corporates globally. Her visionary approach and dedication to fostering knowledge have earned her widespread recognition and accolades as a Women of Inspiration in 2023 by the Canadian Immigrants.

Her academic prowess is as impressive as her professional achievements, holding an MBA from the American University of Sharjah (UAE), a Post Graduate Diploma in GRC from Manchester Business School (UK), and certifications including CAMS, FinTech Program certificate from Oxford University, and Chainalysis Cryptocurrency Fundamentals and Reactor Certifications.

Souzan has carved a niche for herself as an exemplary leader, educator, consultant, and mentor. Her unwavering dedication and extensive knowledge and experience make Souzan an indispensable asset in the fight against financial crime. As she continues to inspire and empower professionals in her field, her impact reverberates far beyond borders, leaving an indelible mark on the industry and the communities she serves.

Garry Clement

CAMLO at VersaBankFinancial Crime Prevention expert and advocate with over 50 years of experience. Garry assumed the

position of Chief Anti-money Laundering Officer for Versabank in March 2022.

Additionally, Garry is President and CEO of Clement Advisory Group. He relies on his 34 years of policing experience, having worked in roles as the National Director for the RCMP’s Proceeds of Crime Program, Liaison Officer in Hong Kong, working as an investigator and undercover operator in some of the highest organized crime levels throughout Canada.

During Garry’s policing career, he received several awards and commendations for his investigative abilities, inclusive of recognitions from the US Drug Enforcement Administration and the CIA. He is the former EVP of the Association of Certified Financial Crime Specialists.

Garry has authored and/or co-authored several papers in national and international publications on

organized crime and money laundering. In 2023 Garry was a contributing author to “Dirty Money,

Financial Crime in Canada edited by Chrisian Leuprecht and Jamie Ferrill. During 2022 and 2023 Garry

worked with Optimum Publishing to finalize his book; “Undercover, Inside the Shady World of Organized Crime and the RCMP”.

Liana Ulikhanyan

CAMLO at Pwc CanadaWith over 15 years of experience, Liana is a results-oriented AML and Compliance expert with a deep understanding of Canadian AML regulations, sanctions, and federal legislation. As a Certified Anti-Money Laundering Specialist (ACAMS) and Advanced Anti-Bribery Specialist, Liana has successfully led AML program integrations and have a proven track record in developing and implementing effective AML programs. Currently serving as the Chief AML Officer at PwC Canada, Liana leads the firm’s AML and Anti-Corruption compliance programs, collaborates with PwC global AML SMEs, and ensures adherence to local and global regulations. Liana’s expertise extends to conducting risk assessments, managing compliance teams, and providing strategic guidance to senior leadership. Throughout her career, Liana has consistently worked to safeguard organizational integrity and mitigate financial crime risks through cross-functional collaboration and strong leadership.

Elizabeth Sale

Partner at Osler, Hoskin & Harcourt LLPElizabeth is a partner at Osler, Hoskin & Harcourt LLP specialising in the regulation of financial institutions and other financial services providers, including banks, foreign banks, captive finance companies, payday lenders, insurance companies, trust companies, loan companies, participants in the payment card industry, money services businesses and fintechs. Her expertise includes advising reporting entities from a range of industry sectors on their legal and regulatory obligations under Canada’s anti-money laundering laws.

Charlene Cieslik

Principle at Complifact AML Inc.

Cameron Field

Vice President at The Vidocq GroupCameron is a Vice President with the Vidocq Group. He leads the firm’s Toronto operations where they consult on enhanced due diligence in private equity and M+A work, financial crime, money laundering, sanctions, regulatory risk and complex corporate investigations. Prior to that he worked in the AML team at BMO as the head of intelligence liaison and operational effectiveness. Prior to his career in the private sector he served 32 years with the Toronto Police Service and retired in 2017. He served in many roles including Officer in Charge of the Threat Assessment team, Investigative Training Team and the Corporate Crimes Unit. Cam holds a BA in Justice Studies, a MSc in Criminology and is a certified anti money laundering specialist. He speaks internationally and has published numerous articles and chapters on financial crime.

Fareda Sands

President at Initium Novum Enterprise LimitedFareda Sands is considered to be a thought leader in the Compliance, Risk and Anti-Money Laundering space in The Caribbean. With many years in the industry, she now heads Initium Novum Enterprise Ltd. The Firm, provides an array of offerings including advisory services specializing in Financial Services Regulations, inclusive but not limited to: AML/Risk Training, Expert Witness and Investigations. She is a Chartered Banker with a Chartered Banker MBA and also holds an MSc in Financial Crime and Compliance in Digital Societies with a Distinction from The University of Manchester, UK.

Fareda is a sought-out speaker for local and international conferences.

Rodney MacInnes

COO & AML Compliance Ninja at Outlier Solutions Inc.Rodney is currently the COO & AML Compliance Ninja at Outlier Compliance Group (Outlier), a

Canadian-based consulting company that set out to break the consulting mould by focusing on 3 core

principles: Value, Open-Source & Continuous Improvement. Rodney became a Certified Anti-Money Laundering Specialist (CAMS) in early 2011, and is also a graduate of the Canadian Institute Financial Crime Analysis course at Seneca College. He is a Certified Bitcoin Professional (CBP) and a Certified

Ethereum Professional (CEP), who fell down the rabbit hole in 2013. His financial compliance experience includes anti-money laundering (AML), counter terrorist financing (CTF), fraud and Legislative Compliance Management (LCM). Over the past 16+ years, Rodney has held positions both in-house and as a consultant, a strategic leader, and a founder. Rodney currently sits on the Canadian Blockchain Consortium’s Regulatory Committee, and the Canadian Money Services Business Association’s Dealers in Virtual Currency Committee. He also sits on the CryptoCurrency Certification Consortium’s (C4’s) Certified Bitcoin Professional Examination Committee, where he assists in revamping the content and training materials for the current certification.

Brian Terranova

AML & Sanctions Compliance Officer at Fan DuelBrian Terranova is the Anti-Money Laundering and Sanctions Compliance Officer for FanDuel Canada. He oversees the financial crimes compliance program, including operations, program development, and advisory. Having been with FanDuel for nearly four years, Brian has helped establish FanDuel’s AML and Sanctions program in both the US and Canada, including advising on strategic program/policy development, governance, and product compliance. Prior to FanDuel, Brian worked in banking where he developed and implemented multiple aspects of AML/Sanctions and data quality programs, including enhancing payments integrity and innovating processing options on payment rails, both domestic and abroad.

Brian is a Certified Anti-Money Laundering Specialist (CAMS) and a Certified International Sanctions Compliance Officer (ISCO). He holds a Master’s degree in International Affairs from the New School University in New York City and a Bachelor’s degree in international relations from the University of Delaware.

Rita Sabri

North America Compliance Director of CorpayRita is currently working as a Compliance Director, North America for Corpay, where she is responsible for the design and operation of the Compliance Program for Corpay’s North America operations and act as SME for Sanctions related matters.

She has more than 15 years of experience in compliance and worked at American Express, B2B Bank and Convera as a Money Laundering Reporting Officer. She is also a Certified Anti-Money Laundering Specialist (CAMS).

Nahid Rahman

Training Team Lead at TCAENahid, is a highly skilled professional in the dynamic world of blockchain analytics.

With a passion for empowering businesses and individuals with cutting-edge solutions, Nahid specializes in developing comprehensive training programs and executing intricate investigation workflows. Throughout his impressive career, Nahid has collaborated with numerous top-tier crypto enterprises, gaining invaluable experience with various blockchain analytics platforms.

His expertise is further reinforced by holding prestigious Advanced CAMS - Financial Crime Investigations (CAMS-FCI), Chainalysis Investigation Specialist Certification (CISC), TRM Achievement of Certification Excellence (TRM-ACE) and Project Management Professional (PMP) certifications, attesting to his commitment to excellence.

Nahid serves as the Training Team Lead and a Chainalysis authorized trainer at TCAE . As an integral part of the institution, he has successfully conducted training sessions for the CCFC, CRC, CEIC and CISC certifications, positively impacting the professional growth of TCAE alumni.

With an unwavering dedication to staying at the forefront of the blockchain analytics domain, Nahid continues to drive innovation and inspire others to excel in this fast-evolving industry. Whether designing tailor-made solutions or guiding aspiring professionals on their path to success, Nahid’s contributions are a testament to his indomitable spirit and exceptional expertise.

Lina Dabit

Inspector at RCMP Federal Policing Cybercrime Investigative Team TorontoLina Dabit joined the RCMP in 1994 and started her career in BC working a variety of duties ranging from uniform patrol, drug section, major crime, intelligence, and border integrity.

After transferring to Ontario in 2008, she focused on organized crime, national security and established the RCMP interview team in Ontario. She was commissioned in 2017 as commander of the Toronto Air Marshal Unit. Since 2021, she has led the Cybercrime Investigative Team and is building an innovative operational Cyber hub focused on collaboration between federal, international and private sector partnerships.

Andres Betancourt

Vice President, AML Sanctions Canada & International Advisory at PNC BankAndres Betancourt joined PNC Bank as a VP, AML/Sanctions Canada & International Advisory in 2024. In this role, Andres is responsible for oversight, advise and strategy of 1st line controls and processes for Corporate and Institutional Banking for Canada Branch and International. Responsible for advice and counsel of Financial Crime and regulatory risk throughout the different stages of a client's lifecycle including onboarding, ongoing monitoring, enhanced due diligence and client exit decisions.

Andres is an experienced financial crime compliance professional with 15 years of experience in regulatory frameworks, risk mitigation, internal audit reviews, data driven projects and policy development across financial services industry including the Bank of Nova Scotia, Bank of Montreal, Royal Bank of Canada, and Grant Thornton LLP. Proven track record in leading compliance groups, enhancing operational procedures, strategic oversight and fostering partnerships to navigate complex regulatory environments. His focus has been on leading the planning, implementation and monitoring of different AML workstreams including Data Governance, EDD, Client Risk Rating, KYC Periodic Refresh, Name and Payment Screening projects across multiple jurisdictions including Canada, United States, Caribbean, and several countries in Latin America.

Erika Postel

AML & Compliance LeaderErika Postel is an accomplished leader in regulatory compliance and operational risk

management with extensive expertise across Canada, Latin America, and the English Caribbean.

With a LLB (Arg.) and ACAMS certification, Erika brings a deep understanding of financial

crimes, AML/CTF regulations, and audit methodologies.

Her career includes notable roles such as Director of AML Program Delivery at The Bank of

Nova Scotia, where she led large-scale AML transformation projects and managed compliance

governance across multiple jurisdictions. Her role involved overseeing AML compliance

programs, coordinating high-risk client remediations, and implementing data-driven risk

strategies. Prior to transition into her corporate law and financial crime career, Erika practiced

criminal law serving as a young offender prosecutor for the City of Buenos Aires, Argentina.

Erika is known for her ability to manage change effectively, build high-performing teams, and

deliver results in dynamic environments. Fluent in English and Spanish, she is also recognized

for her speaking engagements at international conferences and has received accolades for her

contributions to organizational culture and performance.

Neal Read

Provincial Constable at Ontario Provincial PoliceNeal Read is a Provincial Constable with the Ontario Provincial Police. With 17 years of policing experience working in a variety of roles, he has focused his efforts on complex fraud investigations including romance scams, cybercrime and cryptocurrency-based occurrences with a commitment to a victim centered approach.

Currently, Neal works with a local team in responding to cyber-enabled fraud cases investigating, identifying and charging sophisticated offenders and is sought after to provide insight and investigative specialties relating to cryptocurrency in the area.

Neal believes in the continuous development of skills and education and is an advocate in enhancing training for police to combat emerging crime involving cybercrime and crypto. Neal is a Certified Bitcoin Professional (CBP) and holds training through Chainalysis for Reactor, Ethereum Investigation and Investigation Specialist certifications.

Jinisha Bhatt

Founder of Canada Anti-Human Trafficking Consortium (CAHTC)Jinisha B. is an independent crypto compliance consultant, a digital nomad, and an advocate of decentralization. Currently, she offers consultation to Virtual Asset Service Providers (VASPs) operating across multiple jurisdictions. She marries her insights from her previous compliance roles in traditional finance with her experiences in blockchain investigations. Currently, she specializes in investigating well-known as well as emerging typologies in crypto fraud schemes and scams.

When not at work, she works with multiple anti-human trafficking initiatives to help provide actionable insights and training to private and public sectors. Jinisha holds a Certified Anti-Money Laundering Specialist designation (CAMS), a Chainalysis Reactor Certification (CRC), and a Chainalysis Ethereum Investigations Certification (CEIC).

Mickael Ferreira

Detective Constable at Toronto Police ServiceDetective Constable Mickael Ferreira has been a member of the Toronto Police

Service since 2006. The first ten years of his career were predominantly spent in

a Primary Response role and as a Divisional Traffic Officer at 14 Division. In 2017,

Detective Constable Ferreira transferred to the 14 Division Fraud Unit where he

investigated divisional frauds for almost four years. In October 2020, Detective

Constable Ferreira moved to the Financial Crimes Unit for a six month term and

then was welcomed back permanently in July 2021. Detective Constable Ferreira

is assigned to the Financial Crimes Unit – Major Frauds Section and is the Lead

Investigator on many significant fraud projects.

Sheereen Khan

Founder of RegulativitySheereen Khan is a serial entrepreneur with a passion for technology, innovation, and creating impactful solutions. She has supported numerous startups, guiding them from launch to successful exits. Her love for innovation and problem-solving has been the driving force behind her career, leading her to combine her deep expertise in compliance with cutting-edge technology to found Regulativity.

As the founder and CEO of Regulativity, Sheereen leverages over two decades of experience in regulatory adherence and risk management to address the most complex compliance challenges facing businesses today. Her goal is to transform compliance from a burdensome task into a strategic advantage, using advanced AI-powered solutions to streamline processes and manage regulatory change.

With a Bachelor’s degree in Business and Economics and a Master’s in Accounting (CPA) specializing in Forensics & Strategic Risk Management, Sheereen has held key leadership roles across the Financial Services sector, where she led teams through complex regulatory landscapes. Her experience includes designing and implementing robust compliance programs, conducting risk assessments, and integrating emerging technologies into compliance frameworks.

Sheereen’s entrepreneurial spirit, combined with her dedication to ethical business practices, has made her a respected thought leader in the industry. Through Regulativity, she continues to push the boundaries of innovation, offering businesses a comprehensive platform that simplifies compliance and helps them stay ahead of regulatory requirements.

Sean Parker

Managing Director of AML Consultancy IncSean has worked in the more complex of financial crime compliance and risk management with well over a decade of experience. He has focused his efforts within AML in the areas of transaction monitoring, payment risk, regulatory reporting and correspondent banking. Sean has also delivered extensive training sessions to the various lines of defence within a financial institution on a variety of topics, including but not limited to: Fraud Risk Management Trends, Sanctions, Bribery and Corruption, Market Risk/Fraud Risk, Migration of SWIFT MT to MX and Correspondent Banking. Sean has consulted with a variety of reporting entities and has worked within a global and local financial institution.